56+ what percentage of monthly income should go to mortgage

Veterans Use This Powerful VA Loan Benefit For Your Next Home. On a monthly income of 5000 your monthly debts can add up to 1800.

What Percentage Of Income Should Go To Mortgage

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. On a 400000 property a 20. Web Front-end only includes your housing payment.

Ad Calculate Your Payment with 0 Down. 1800 5000 036 which. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income.

Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Apply Easily Save. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Ad Compare the Best Home Loan Lenders for March 2023. Ad Calculate Your Payment with 0 Down. Web What percentage of your monthly income should go to mortgage.

With that your other monthly debt should fit in under the overarching cap of 36. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. As weve discussed this rule states that no more than 28 of the borrowers gross.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. John in the above example makes.

Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web The 2836 is based on two calculations. Web Learn how to calculate what percent of your net income should go toward mortgage payments each month so you dont overspend.

Ad Compare the Best Home Loan Lenders for March 2023. Web Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre.

The 30-year rate averaged. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Web What Percentage Of Your Monthly Income Should Go To Mortgage A general rule of thumb for homebuyers is your home loan should eat up no more than.

The current rate for a 30-year fixed-rate mortgage is 673 008 percentage points higher than a week ago. Compare Find the 10 Best Pre Approval Home Loans In US. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Learn how to calculate what percent of. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Compare Find the 10 Best Pre Approval Home Loans In US.

Find A Lender That Offers Great Service. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The 36 rule applies to the back-end ratio or your DTI ratio.

Web The 3545 model. And you should make. Our Calculators And Resources Can Help You Make The Right Decision.

Web The 36 should include your monthly mortgage payment. Ad Compare More Than Just Rates. A front-end and back-end ratio.

Apply Easily Save. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web 1 day agoMortgage rate trends.

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percent Of Income Should Go To My Mortgage

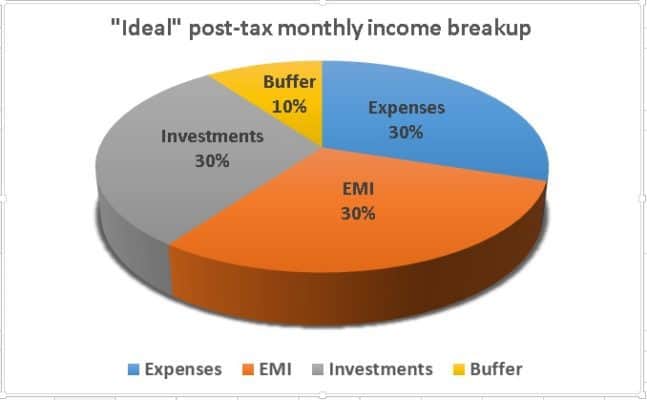

What Percentage Of Monthly Income Should My Home Loan Emi Be

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Percentage Of Your Income Should Go To Mortgage Chase

What Percent Of Income Should Go To My Mortgage

What Percentage Of Your Income Should Go To Mortgage

What Percentage Of Income Should Go To Mortgage Morty

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage

Free 56 Loan Agreement Forms In Pdf Ms Word

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage Banks Com

What Percentage Of Your Income Should Go To Mortgage

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

What Percentage Of Your Income Should Go To Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment